Cape Paterson Property Market Summary: April 2025

Based on the comprehensive sales data for Cape Paterson (postcode 3995) over the past 6 months, the local property market is showing clear signs of price correction. This analysis examines recent trends and offers projections to help current sellers make informed decisions.

Current Market Conditions (October 2024 - April 2025)

The Cape Paterson market has experienced a consistent downward trend in prices over the last 6 months, with the following key indicators:

List Price vs. Sale Price Analysis

Nearly every property (26 out of 30) that sold in this period experienced some form of price reduction. The most severe price drops reached:

Even premium properties saw significant reductions:

Recent Sales Trends (Jan-Apr 2025)

More recent data shows the downward trend accelerating:

Properties priced accurately from the outset are selling more quickly (typically under 30 days), while overpriced properties face extended market periods averaging 3-4 months and ultimately sell for significantly less than their initial asking prices.

Market Projections for Next 12 Months

Based on current trends, the Cape Paterson market is expected to continue its correction phase:

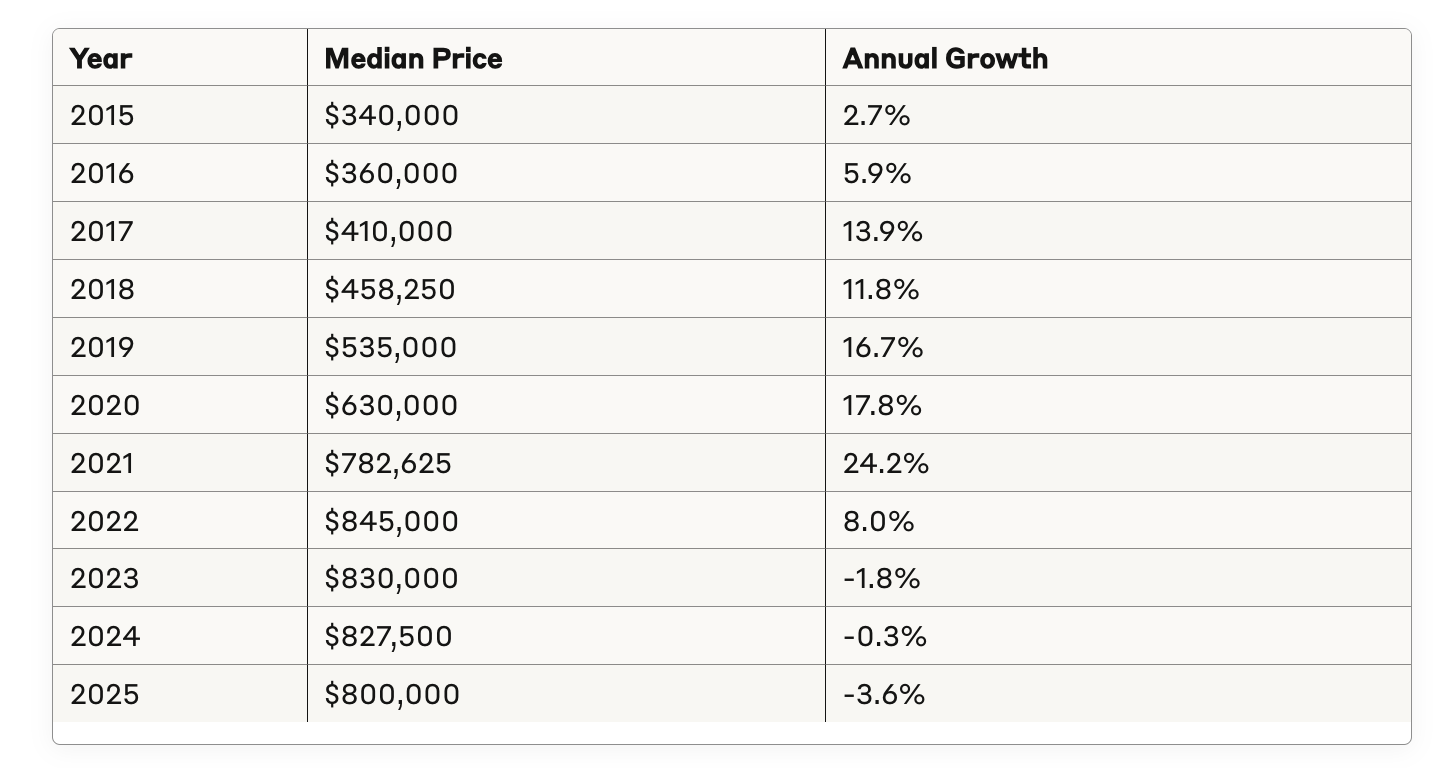

To fully comprehend the current correction, we need to examine Cape Paterson's remarkable growth journey:

This data reveals an extraordinary growth period from 2017-2021, where Cape Paterson experienced cumulative growth of approximately 90% over just five years. The current correction represents a minor adjustment in the context of this exceptional growth trajectory.

When compared to other Victorian beach towns within two hours of Melbourne, Cape Paterson displays several distinctive characteristics:

When compared to other Victorian beach towns within two hours of Melbourne, Cape Paterson displays several distinctive characteristics:

Pricefinder data suggests Cape Paterson experienced a less pronounced correction compared to premium markets like Flinders (estimated 8-12% decline), but a more significant adjustment than established markets like Ocean Grove and Barwon Heads (estimated 2-4% decline).

An interesting counterpoint to the sales market correction is the relative strength of Cape Paterson's rental market:

This positive rental yield growth suggests investor interest remains relatively strong despite the sales market correction. With median weekly rents ranging from $400 to $700 depending on property quality and location, the rental market provides a buffer for investors concerned about short-term capital growth. The higher-end rental properties commanding $600+ weekly (such as 10 Stargazer Avenue and 42 Surf Beach Road) demonstrate continued demand for quality accommodation in the area.

The most active price segments in Cape Paterson over the past 12 months have been:

Notably, the luxury segment above $1.2 million has shown continued activity with multiple sales, while the entry-level market below $500,000 has significantly contracted. This suggests that while the market is correcting, it's not experiencing a fundamental reset to pre-boom values.

Analysis of the recent sales data reveals increasing days on market for many properties:

This extended time-to-sell indicates a shift to a buyer's market where careful pricing and presentation are becoming increasingly critical factors in achieving timely sales.

For investors considering Cape Paterson in 2025, several strategic considerations emerge:

The recent data suggests Cape Paterson is experiencing a measured correction rather than a fundamental market reset. The pace of development in The Cape eco-village and continued infrastructure improvements will likely be key determinants of how quickly the market stabilises and returns to growth.

Cape Paterson's market correction should be viewed in context – following cumulative growth of approximately 150% since 2015, the current 3.6% decline represents a minor adjustment in a longer-term growth trajectory.

For homeowners, this suggests holding through the correction remains a viable strategy, particularly given the continued strength of rental returns for those able to temporarily transition to landlord status.

For prospective buyers, the current environment offers improved negotiating position and reduced competition, particularly in the traditional Cape Paterson market segments away from the premium eco-village properties.

The data clearly indicates Cape Paterson has transitioned from the exponential growth phase of 2019-2021 to a period of price discovery and consolidation. However, its fundamental appeal as a coastal lifestyle destination with unique environmental credentials suggests this correction is likely temporary rather than structural.

As we look ahead to late 2025 and 2026, market participants should focus on the area's long-term value proposition while navigating the short-term price adjustment with strategic patience.

Leo Edwards is an award-winning real estate agent specializing in the Inverloch property market. With access to comprehensive market data and deep local knowledge, Leo provides unparalleled expertise to buyers and sellers navigating this dynamic coastal market. For personalised advice on your property journey, contact Leo today.

GET INSTANT PROPERTY VALUE

“We can’t thank Leo enough for the professional, courteous and friendly way he sold our home in such a short time in a challenging market. He spent many hours keeping us updated and was always available for progress on our sale. His marketing skills are outstanding and way beyond other agencies. We recommend him highly, a true legend. 👍👏